Earnings From a Limited Partnership Would Be an Example of

Choosing the right legal structure is a necessary part of running a business. For example common-law employees who are ministers members of religious orders full-time insurance salespeople and US.

Limited Partnership Meaning Liability Vs General Partnership

In subscribing to our newsletter by entering your email address you confirm you are over the age of 18 or have obtained your parentsguardians permission to subscribe and agree to.

. Partnership Equity Equity 10 Year LIH Tax Credit Annual LIHTC Sale Price - Commercial Tap Impact Fees 000 000 000. Limited partners on the other hand will not run the business on a day-to-day basis and will only risk their personal investment in the partnership. General partners should reduce this amount by certain expenses before entering it on Schedule SE.

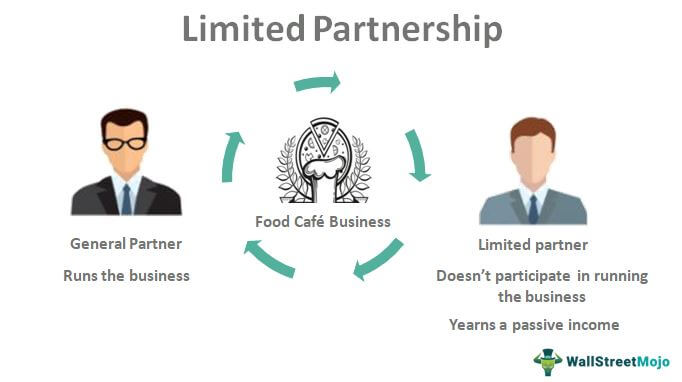

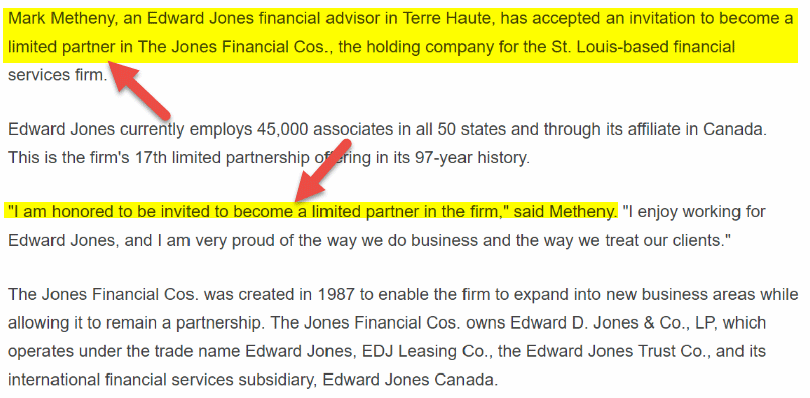

Example of Limited Partnership. Joe is the general partner and Quin is a limited partner. Example of a Development Budget and Operating Pro Forma for a Commercial andor Mixed-Use Project.

More Family Limited Partnership FLP. Quin has infused 75000 in the business. A Limited Liability Corporation LLC and a Limited Liability Partnership LLP are both legal vehicles for separating business owners and their assets from their business.

See your Schedule K-1 instructions. But beyond the common characteristic of reducing ones exposure to liability there are some important differences to note between an LLC and an LLP. Tag them to make sure they apply.

Typical is 99 to 9999. Citizens employed in the United States by foreign governments cant set up retirement plans for their earnings from those employments even though their earnings are treated as self-employment income. 2458 Likes 120 Comments - University of South Carolina uofsc on Instagram.

Select one of the 3 options below for pricing equity. As an example in year one a corporation closes its books and its net income of 100000 is closed out to the retained earnings account. Limited partnerships are more attractive to investors because their liability will be limited.

Section 129 sub section 3 states that Where a company has one or more subsidiaries it shall in addition to financial statements provided under sub-section 2 prepare a consolidated financial statement of the company and of all the subsidiaries in the same form and manner as that of its own which shall also be laid before the annual general meeting of the. Limited partners will still receive a proportionate share of the business profits and losses. Joe runs a food café and Quin is a business partner.

Whether youre just starting out or your business is growing its important to. If you were a general or limited partner in a partnership include on line 1a or line 2 whichever applies the amount of net earnings from self-employment from Schedule K-1 Form 1065 box 14 code A. In each successive year the net income or loss is closed to retained earnings and the cumulative amount in retained earnings at any point in time represents those cumulative earnings.

A limited partnership is when two or more partners go into business together with the limited partners only liable up to the amount of their investment. Do you know a future Gamecock thinking about GoingGarnet. Percentage ownership by limited partners.

Such earnings include salary wages rent received royalty commission interest received.

Limited Partnership Meaning Liability Vs General Partnership

Business Ownership Structure Types Business Structure Bookkeeping Business Business Basics

Limited Partnership Meaning Liability Vs General Partnership

No comments for "Earnings From a Limited Partnership Would Be an Example of"

Post a Comment